Top 3 Banking Automation Software Tools for Finance Teams

Banks manage huge amounts of data every day, from checking accounts to loan applications. Many of these steps still depend on manual processes, which create delays and errors.

Banking automation software cuts those issues by replacing repetitive work with automated workflows. It also improves compliance and makes it easier to serve customers quickly.

By automating manual processes at banks and financial institutions, you save time, reduce risk, and improve accuracy.

In this article, you'll learn why automation matters, where it makes the biggest impact, and which tools lead the market today.

Join thousands already automating banking workflows and sign up for free!

Why Do Banking Organizations Need Automation Software Today?

From customer onboarding to daily business needs, banks handle more than ever. Automation helps staff focus on higher-value work with the benefit of speed and accuracy.

Automating KYC and AML Compliance

Banks have to meet strict rules, and automation helps them handle them faster.

Know-your-customer (KYC) checks move quickly when customers upload IDs, and the system runs document verification instantly. Data gets compared to official watchlists, and risk scores decide who needs closer checks.

On the anti-money laundering (AML) side, tools scan transactions in real time and flag suspicious activity without flooding you with false alerts. That keeps staff focused and reduces wasted time.

Automated monitoring also makes regulatory compliance easier, with clear logs for reporting.

Loan Processing and Underwriting

Lending takes time when you depend on manual processes. Automation cuts those delays by turning loan origination into a digital process. Applicants send documents online, and intelligent tools handle the details.

Credit scores are checked automatically, income verified, and data sorted for review. Strong applications get loan approvals quickly, while risky ones are routed to underwriters.

Automated systems also cover:

- Transaction processing

- Compliance checks

With fewer paper files and less back-and-forth, you shorten processing times and give borrowers faster answers.

Fraud Detection and Risk Management

Fraudsters move quickly, and you need to move faster. Automated platforms monitor transactions in real time and highlight suspicious activity the moment it happens.

On the other hand, risk scoring supports risk mitigation by ranking cases.

Customer Service and Chatbots

People want answers right away, and automation makes that possible. Chatbots handle common manual tasks like:

- Balance checks

- Payment setup

- Card issues

If the issue is serious, the system passes it to a human agent with full context, so nothing gets repeated. The result is better customer experience, shorter wait times, and more consistent support.

3 Best Banking Automation Software Tools in 2025

Banks depend on automation to manage financial services. New agentic automation tools help them move faster and work smarter, such as:

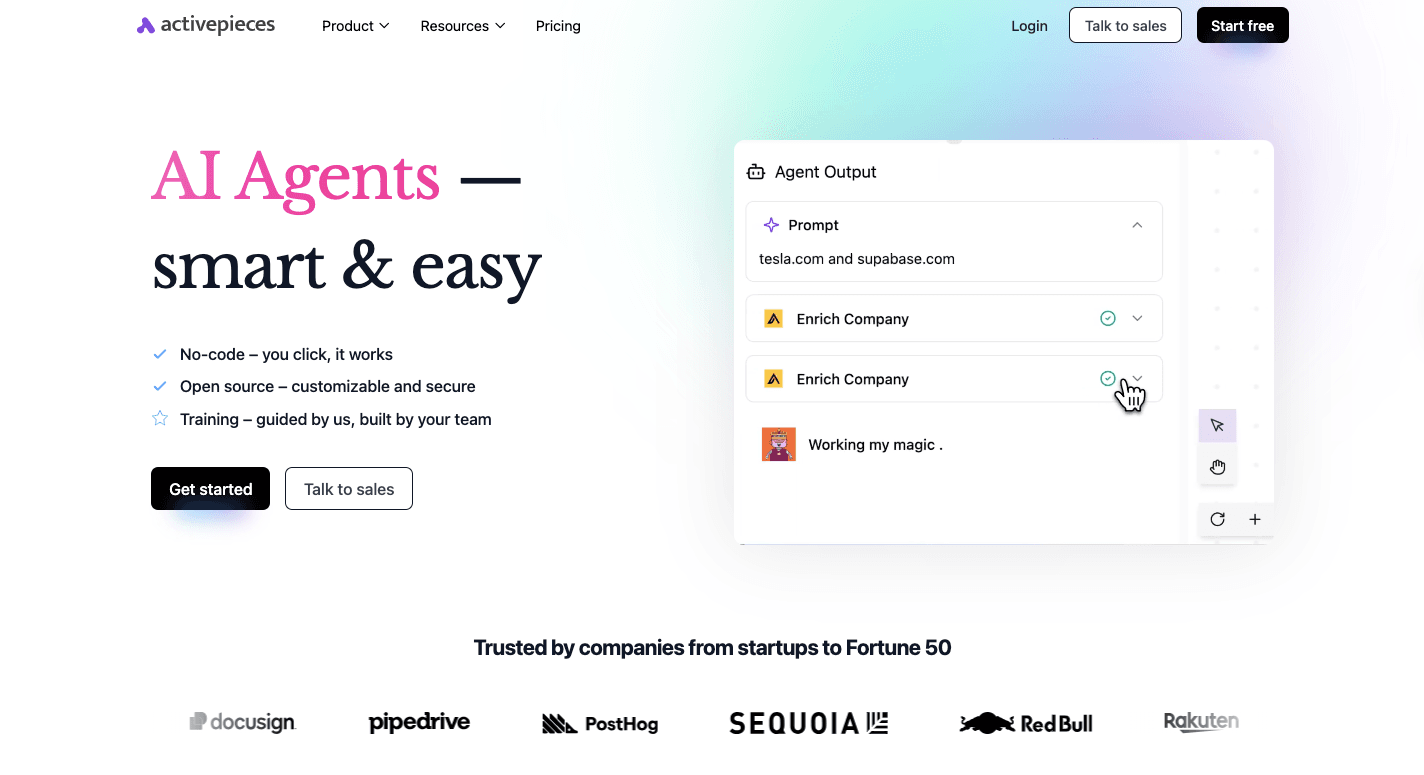

1. Activepieces

The financial industry adopts Activepieces, an open-source with a fully on-prem deployment capability, since it offers data security and safe transfer. With self-hosting, you stay in control of workflows and meet compliance requirements without compromise.

Besides that, the Activepieces community contributes new data integrations, called pieces, every week. Currently, 434 integrations are available, covering a wide range of applications, from finance software to AI connectors.

You don't need a coding background; you can take advantage of no-code development through a drag-and-drop builder. That makes automation accessible for departments outside of IT. With native AI support, you can further automate complex operations.

Key Features

- Open-source foundation - Community-driven platform with frequent updates.

- Data security - On-prem deployment keeps all information under the bank's control.

- No-code development - Drag-and-drop interface lets you build automations.

- AI-ready connectors - Includes native AI services for risk scoring and fraud checks.

- Developer-friendly - TypeScript pieces allow customization for advanced needs.

- Hybrid deployment - Supports both self-hosted and cloud use cases.

- Constant expansion - Growing integration library fueled by community and partners.

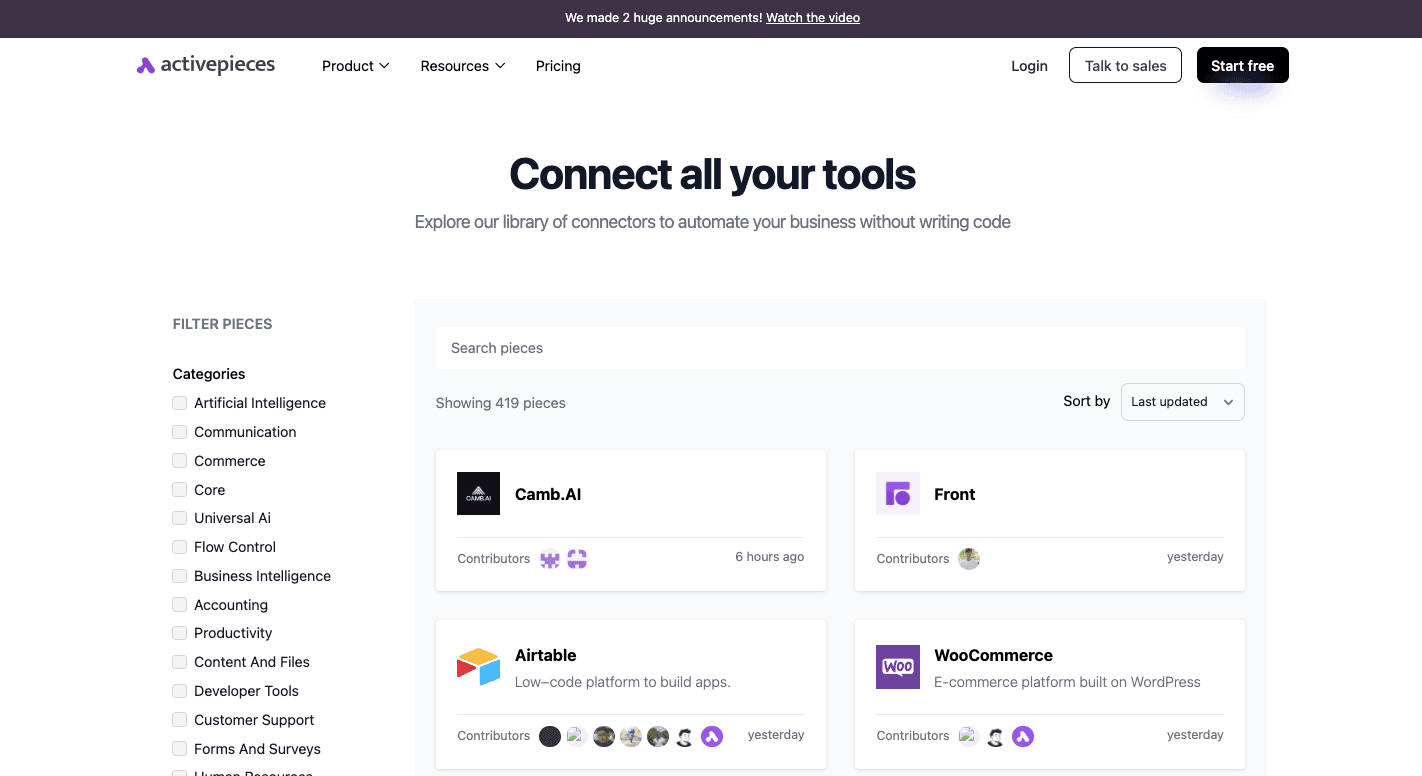

Integrations

Activepieces currently supports 434 pre-built integrations. These cover a wide mix of categories, including finance, customer support, productivity, marketing, and AI.

Banks can connect with services like:

- Zoho Books

- Microsoft Power BI

- Stripe

- Slack

Because the ecosystem is open source, developers add pieces regularly, which means the library continues to grow without delays.

The platform allows you to create your own custom connectors in TypeScript, too, so you can adapt quickly to new systems or requirements.

Use Cases in Banking

Activepieces manages multiple banking operations and runs complex workflows. Aside from that, it:

- Automates entire digital workflows, from account opening to customer onboarding.

- Sends transaction alerts and manages service requests with fewer delays.

- Integrates with existing banking applications to automate loan approvals.

- On-prem deployment ensures banks remain in charge of their automation to reduce costs and improve returns.

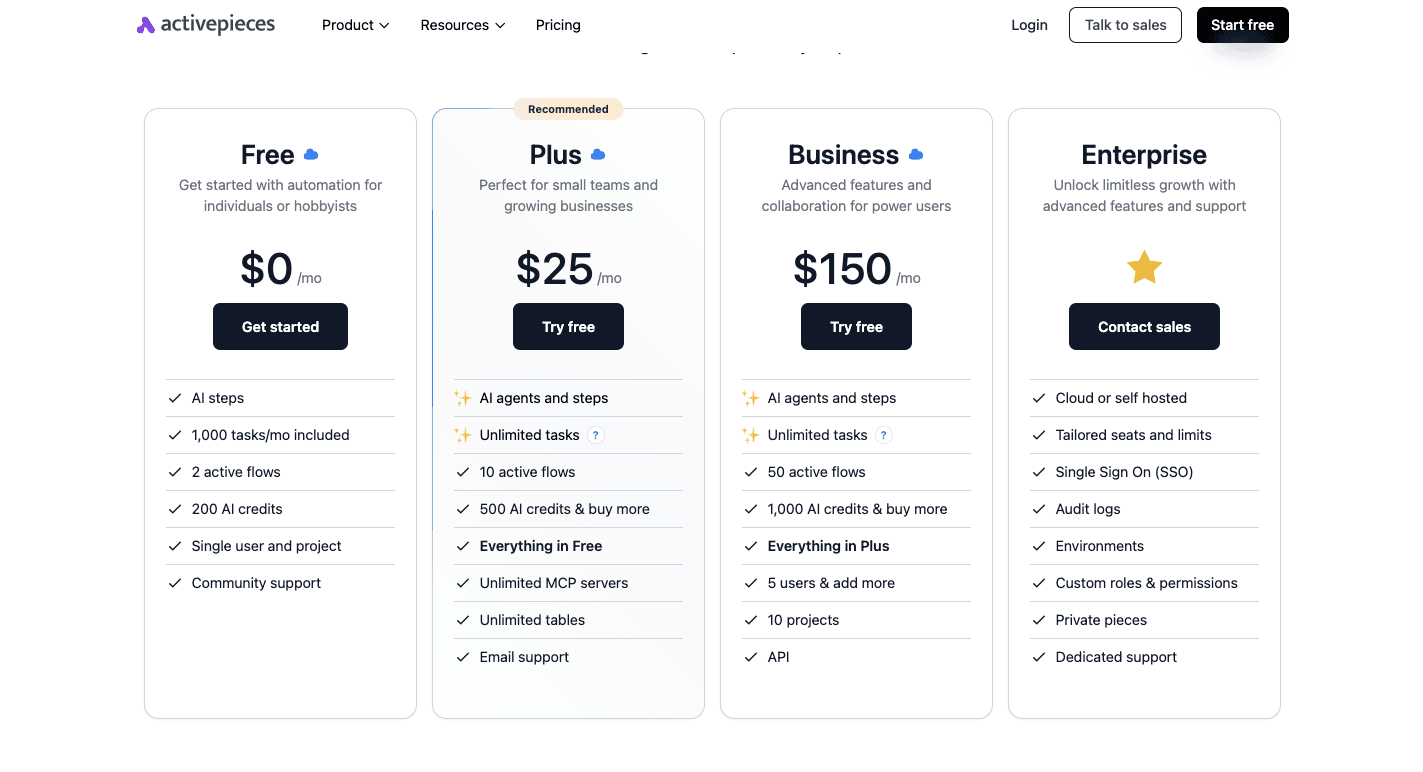

Pricing

Activepieces offers open-source and hosted plans. The free Community Edition allows unlimited self-hosted tasks with full control over data.

Cloud-hosted tiers begin with the free plan that covers a thousand tasks per month. The Plus plan costs $25 monthly, while the Business plan costs $150 per month with more flows, AI credits, and project support.

The enterprise plan is customized based on resources and deployment needs.

Ready to see how automation fits your bank? Talk to sales now!

2. MuleSoft

MuleSoft acts as the connector for banks that use old systems and newer apps. Many financial institutions run into problems when data sits in silos, and MuleSoft helps break those down.

The platform allows banks to automate some banking operations, such as customer relationship management or loan origination, by linking everything through API integrations. Those APIs take information from core systems and make it usable across different applications.

With that in place, you can build automated workflows that cut down processing times and save time for employees. For instance, a managing director sees MuleSoft as an automation program that connects together customer onboarding, payments, or fraud checks in one consistent flow.

Key Features

- API-led connectivity - Links data through three layers of APIs: system, process, and experience.

- Reusable assets - Offers a library of connectors, templates, and APIs to cut setup time.

- Hybrid deployment - Supports cloud, on-premises, or containers, depending on infrastructure needs.

- Automated workflows - Let teams connect tasks like customer onboarding and reporting across systems.

- Real-time data handling - Moves information quickly to support loan approvals or fraud alerts.

- Centralized management - Provides one interface for monitoring and governance.

- DataWeave language - Transforms and maps data across different formats.

Pros

- Connects legacy systems with modern apps.

- Asset reuse cuts development costs.

- Real-time processing improves response speed.

Cons

- Steep learning curve for new teams.

- Requires technical staff to manage.

- Some dependency on the Salesforce ecosystem.

Pricing

MuleSoft doesn't share its pricing publicly.

3. UiPath

UiPath is a robotic process automation (RPA) platform in banking. In contrast to MuleSoft, which focuses on system integration, UiPath delivers bots that act like digital workers. These bots can log in, copy and paste data, send emails, or complete forms.

It further reduces manual effort in areas such as customer onboarding, loan origination, fraud detection, and compliance reporting. Large institutions that process thousands of requests every day also save resources by letting bots handle routine activity in the background.

You even get infrastructure management capabilities through two main deployment models: Automation Cloud (SaaS) and Automation Suite (self-hosted). Those banks that prefer control can do self-hosting. Meanwhile, you can use the cloud for faster setup.

Key Features

- Workflow builder - A simple drag-and-drop design makes automation accessible.

- Recording tools - Capture user actions to generate automation sequences.

- Attended and unattended robots - Bots that either assist humans or run tasks on their own.

- Orchestrator - Central hub for scheduling, monitoring, and managing robots.

- AI integration - Connects with models for fraud detection, credit checks, or predictions.

- Cross-platform support - Runs across desktops, browsers, and virtual environments.

- Analytics and insights - Dashboards show performance metrics and automation results.

Pros

- User-friendly design with drag-and-drop tools.

- Wide coverage from RPA to AI-driven automation.

- Deployment options are available in both cloud and on-premise setups.

Cons

- Advanced projects require more technical knowledge.

- Bots can break when apps update their interfaces.

- Debugging large projects is time-consuming.

Pricing

UiPath's entry-level plan begins at around $25 per month, covering basic personal automations on a limited scale. Standard and Enterprise plans don't have publicly available pricing.

Maximize Banking Industry Compliance and Accuracy With Activepieces

Compliance in banking leaves little room for error. Activepieces gives institutions the control to handle strict rules while keeping data secure.

With full on-prem deployment available, you can manage sensitive information without relying on external servers. That level of data security matters when regulators expect every record to be protected and auditable.

You can connect easily with your existing systems through more than 434 integrations.

It further offers no-code development alongside advanced customization. Non-technical teams can build automations with a drag-and-drop interface, while developers extend the system for complex needs.

Features like human-in-the-loop approvals provide oversight for cases that require manual review.

Banks using Activepieces improve accuracy and stay aligned with regulatory standards. It allows financial institutions to replace repetitive compliance work with consistent automation, so staff can focus on higher-value decisions.

Automate loan processing and compliance reporting with Activepieces today!

FAQs About Banking Automation Software

What is banking automation?

Banking automation uses technology to replace repetitive tasks such as account updates, payment reconciliation, or regulatory reporting.

Modern platforms rely on intelligent automation (IA), machine learning, and rule-based workflows to cut down on manual data entry, reduce human error, lower costs, and ensure compliance.

Banks adopt automation to adapt to changing market conditions and prepare for the future of digital finance.

Which software is mostly used at banks?

Banks often rely on platforms like Activepieces, UiPath, and MuleSoft for automation. These tools connect core systems, handle back-office processes, and improve efficiency.

What is T24 banking software?

T24, now known as Temenos Transact, is a banking system used globally. It manages deposits, loans, payments, and other core banking functions. Institutions use it to integrate front-office and back-office operations in one centralized platform.

What is the best software for automation?

The best software depends on business size and needs, but Activepieces stands out for combining no-code with enterprise-level control and scalability.