Automation in Banking: Redefining How Operations Get Done

A typical day in the financial services industry runs on constant motion. Tellers handle deposits, review loan applications, and verify endless customer data while deadlines pile up.

Behind every approval sits a lot of paperwork, cross-checks, and manual reviews. Many banks still depend on legacy systems that keep things working, but slow everything down.

As transaction volumes rise, mistakes, delays, and frustration grow with them. But modern automation in banking offers a way out. It replaces slow, outdated steps with faster automation tools that bring significant cost savings and sharper accuracy.

In this article, you’ll learn how automation transforms banking operations.

The Benefits of Banking Automation Workflows

Automation in banking replaces error-prone routine tasks with automated systems that improve accuracy and reduce pressure. It also lowers operational costs and frees you from manual tasks, so you have time for more important things, such as providing personalized financial advice.

Other benefits of automating bank processes that traditional banking systems can’t provide include:

- Accelerate processes like loan approvals or account opening as automation tackles repetitive tasks.

- Human error is minimized by automating data entry and calculations, which improves the accuracy of financial records and reduces the risk of costly mistakes.

- Faster processing times and 24/7 access to certain services through automation enhance customer satisfaction.

- Automation can analyze vast amounts of transaction data to identify suspicious patterns and flag potential fraud attempts proactively.

- Automating tasks like report generation and regulatory checks ensures adherence to compliance standards, reducing the risk of penalties and reputational damage.

These improvements create reliable financial data, faster transaction processing, and a secure environment that enables banks to handle growing transaction volumes with confidence.

Bank Operations That Can Be Automated

Outdated legacy systems make it harder to keep up with increasing data and customer demands. Yet through automated banking processes, you can manage higher workloads and give customers faster service.

Every financial institution should prioritize these operations when adopting automation to experience operational efficiency:

Customer Onboarding

Customer onboarding is where every banking relationship begins. It’s the process of collecting customer data, confirming identity, and setting up new accounts in a safe and organized way.

When you rely on manual work, this process often drags, with errors and delays that frustrate customers. Automation fixes that by replacing repetitive data entry with digital forms, AI-based checks, and automatic approvals.

Banks that automate onboarding can run know-your-customer (KYC) and compliance checks within seconds. Customers don’t wait for days to open accounts, which improves customer experience right from the start.

Common automation in customer onboarding:

- Streamlining document processing: Implement intelligent document processing (IDP) to extract and organize information from customer-submitted documents.

- Automating approval workflows: Utilize rule-based systems to expedite approvals for low-risk accounts, which leads to better resource allocation for complex cases.

Loan Processing

Every loan starts with a request and ends with money in a customer’s hands. In between, there are dozens of steps: reviewing forms, checking records, and running risk checks.

Without automation, loan processing progresses so slowly and often gets held up by manual reviews. Automated loan processing changes by moving information smoothly from one stage to the next.

Modern automation systems extract data from loan applications, confirm income and employment, and run credit risk assessment automatically. Since the process is automated, your customers get faster loan approvals.

Automating payment data tracking and compliance checks also improves accuracy across departments. For customers, automation brings quicker funding and a simpler, fairer process that builds confidence in your bank.

Common automation for loan processing:

- Automating credit scoring and risk assessment: Utilize data-driven models to automate creditworthiness evaluation for loan applications.

- Streamlining document collection and verification: Implement secure online portals for applicants to submit documents and utilize IDP for faster processing.

- Automating approval notifications: Send automated notifications to customers regarding loan application status and next steps.

Customized Customer Service

Today, people expect help that’s fast, personal, and always available. Automated workflows make that possible by giving each customer the right help at the right time.

Banks now use chatbots and artificial intelligence (AI) assistants to handle routine inquiries like account balances, password resets, and simple requests. It also helps you gather customer feedback to learn what people want and fix common problems quickly.

Automation turns support from a reactive service into a proactive one. It lets you offer real help, 24 hours a day, across every channel.

Common automation in customer service:

- Automating account management tasks: Allow customers to manage routine actions like updating contact information, requesting new debit cards, or reporting lost cards through self-service portals.

- Integrating sentiment analysis: Utilize AI to analyze customer interactions and identify areas for improvement or opportunities for personalized assistance.

Back-Office Operations

Back-office work keeps banks running smoothly, even if customers never see it. These banking operations cover areas like accounting, payroll, reconciliation, and IT maintenance.

Automation streamlines operations by handling these tasks automatically and consistently. For example, systems can pull information from multiple departments, match payment records, and create compliance reports without any manual effort.

By automating the back office, you also gain clearer insight into your finances and compliance. When the back office runs efficiently, your front-line teams can respond to customers more quickly, strengthening the entire operation.

Common automation in back-office operations:

- Automating reconciliation processes: Eliminate manual data entry and streamline reconciliation between internal systems and external sources.

- Automating regulatory reporting: Generate compliance reports automatically based on predefined rules and data extraction from core banking systems.

Fraud Detection and Prevention

With threats to financial institutions on the rise, keeping money and information safe is more important than ever. Manual checks can’t keep up with the number of transactions you process each day, which makes automation a must.

An automated system monitors activity in real time and flags any unusual transaction patterns that might indicate fraud or misuse. It also improves data security by reviewing millions of transactions in seconds and comparing them to expected behavior.

Automated fraud prevention systems further learn and adapt through machine learning (ML), adjusting to new tactics as criminals change their methods.

Common automation for fraud detection and prevention:

- Automating account blocking and alerts: Automatically trigger account blocking or alerts for suspicious transactions to prevent financial losses.

- Integrating behavioral analytics: Analyze customer behavior patterns to identify anomalies and prevent potential fraudulent activity.

Considerations When Choosing a Banking Automation Technology

The banking industry involves a lot of routine processes which are often time-consuming. Inconsistencies also arise due to human error in handling large amounts of data used by the bank.

When choosing an automation tool for a bank, there are several criteria to consider, such as:

Security

In banking, trust begins with protection. Every automation solution should meet strict industry rules and keep sensitive customer data safe from leaks or misuse. Platforms like Activepieces let you host workflows on your own servers, so you have full control over access and privacy.

Built-in encryption keeps data safe while it’s stored and during transfer, too. Clear access controls make sure only authorized employees can access sensitive files.

When automation focuses on security, you protect customers and meet compliance standards without slowing daily operations.

Functionality and Reliability

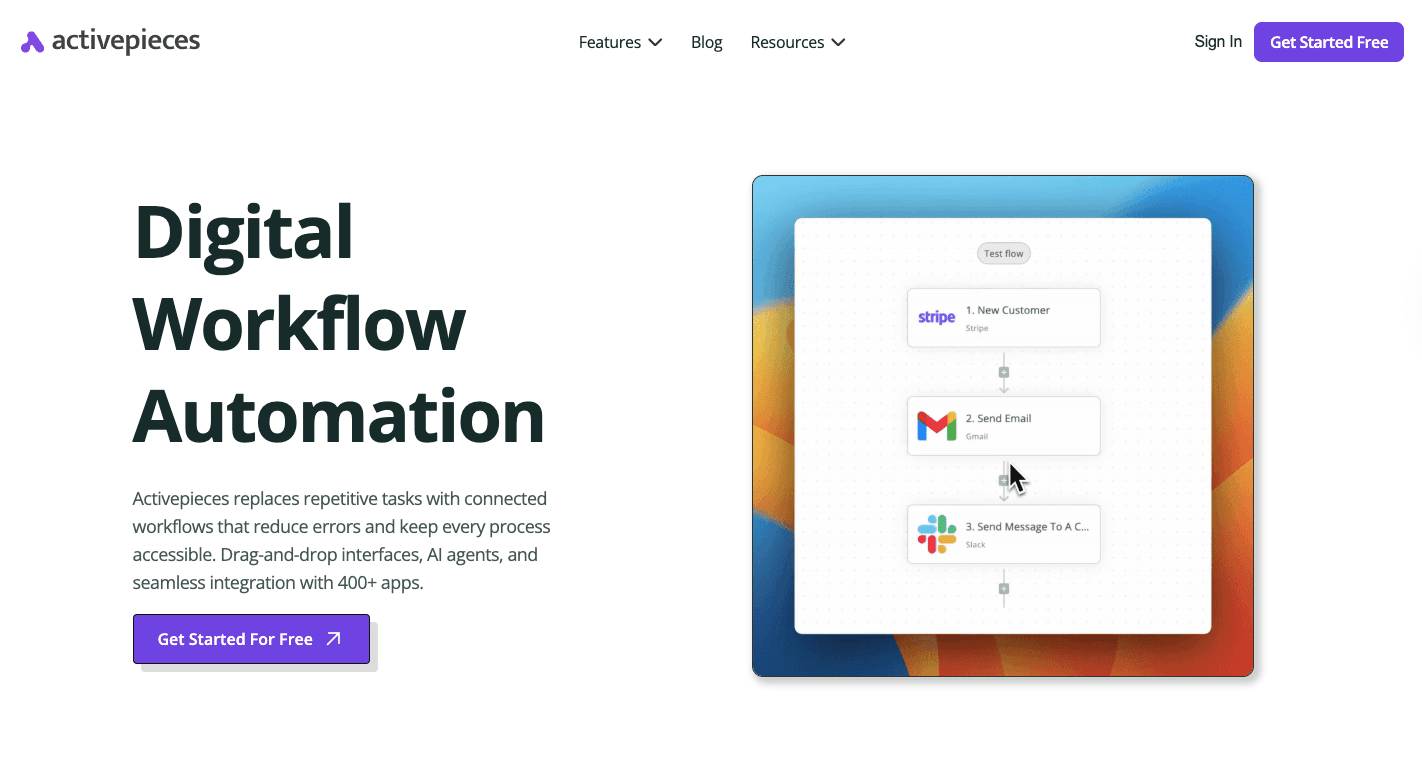

Automation works only when it performs consistently. The best system handles routine banking operations like loan processing, reporting, and compliance without interruptions. It should connect easily with your existing systems and move data smoothly from one point to another.

These automated solutions should also scale as your workloads grow, supporting both small branches and large institutions. Activepieces stands out because it stays stable even as tasks multiply, so you stay efficient.

Usability

In financial services, not everyone on your team is a developer, so platforms need to be simple to learn and manage. Activepieces offers a drag-and-drop interface that lets anyone build automated systems without coding.

A user-friendly design also means fewer errors and faster results. When automation is easy to use, you adopt it faster, and customer service improves across every channel.

Why Choose Activepieces for Banking Automation

Activepieces is an open-source, no-code platform designed to simplify automation for banks. It lets you build and manage automation systems that connect data and workflows without heavy development.

In the banking sector, where compliance and accuracy are non-negotiable, Activepieces offers privacy and security. You can host it on your own servers or use its cloud version.

Since it uses intelligent automation, the system learns, adapts, and makes decisions in real time. It fits easily into your existing systems, so you can modernize your banking operations and not relearn new software.

From automating customer onboarding and customer service, Activepieces delivers dependable performance with an intuitive interface that anyone can use.

Key Features

- Open-source platform – Offers transparency, community-driven improvements, and full customization for any automation setup.

- AI-ready design – Integrates AI for data analysis, fraud alerts, and predictive actions that improve accuracy.

- Drag-and-drop builder – Lets users build workflows without coding, speeding up deployment and updates.

- Flexible hosting options – Choose between cloud or on-premise hosting for total control of data and operations.

- Security layers – Includes encryption, user permissions, and detailed audit logs to protect all transactions.

- Seamless integrations – Connects directly to CRMs, payment systems, and analytics tools without disrupting workflow.

Banking Workflow Templates Inside Activepieces

Activepieces offers pre-built workflow templates that help banks automate their most common processes. These templates make it easy to deploy automation quickly while keeping flexibility for adjustments.

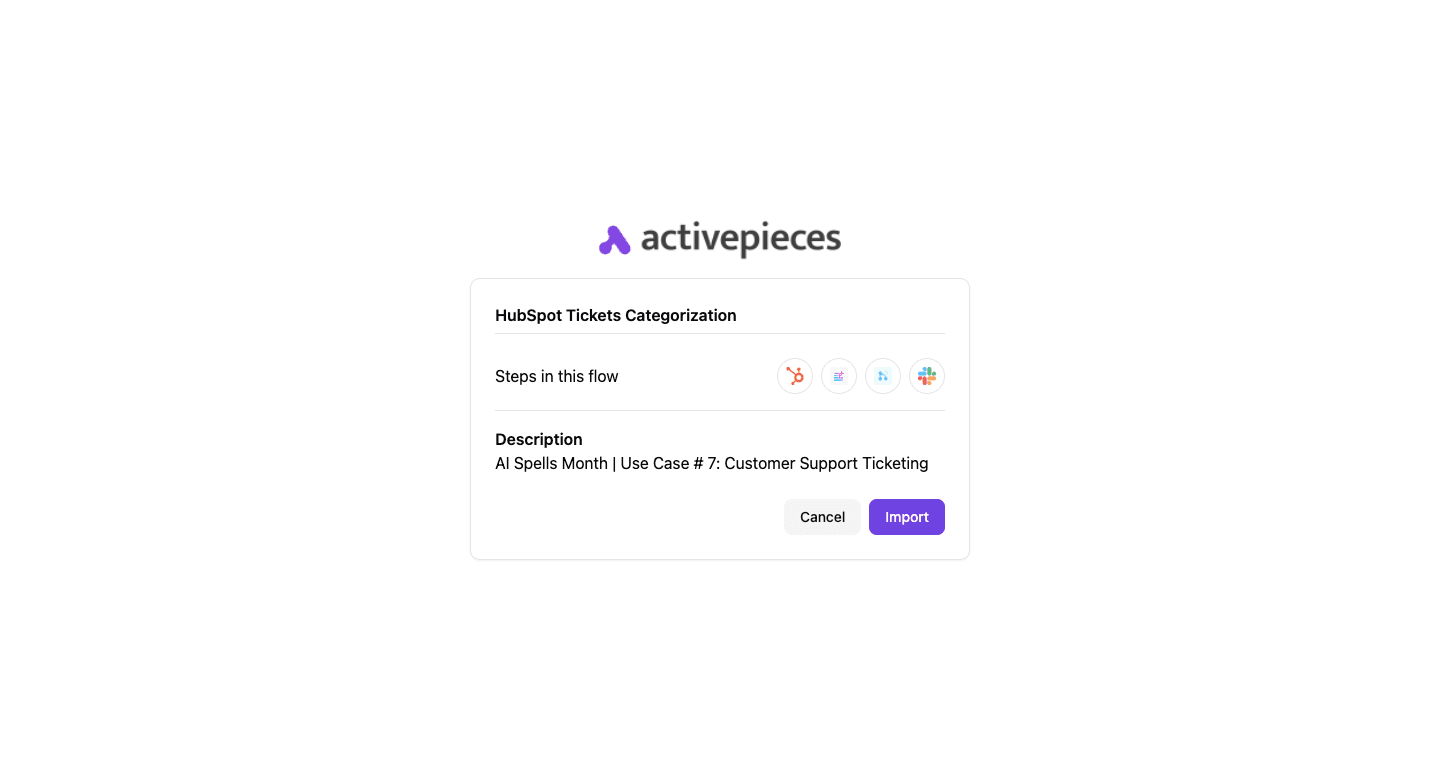

Customer Support Ticketing

The Customer Support Ticketing template helps banks respond to support requests faster and more accurately. It categorizes and routes messages automatically to the right team while using AI to clean up and summarize incoming issues.

Process:

- AI rewrites ticket details for clarity

- Categorizes tickets by department or urgency

- Sends email or Slack notifications to staff instantly

- Tracks progress to make sure no ticket goes unanswered

The result is quicker response times, fewer missed issues, and better communication between teams and customers.

Get the template here: Customer Support Ticketing

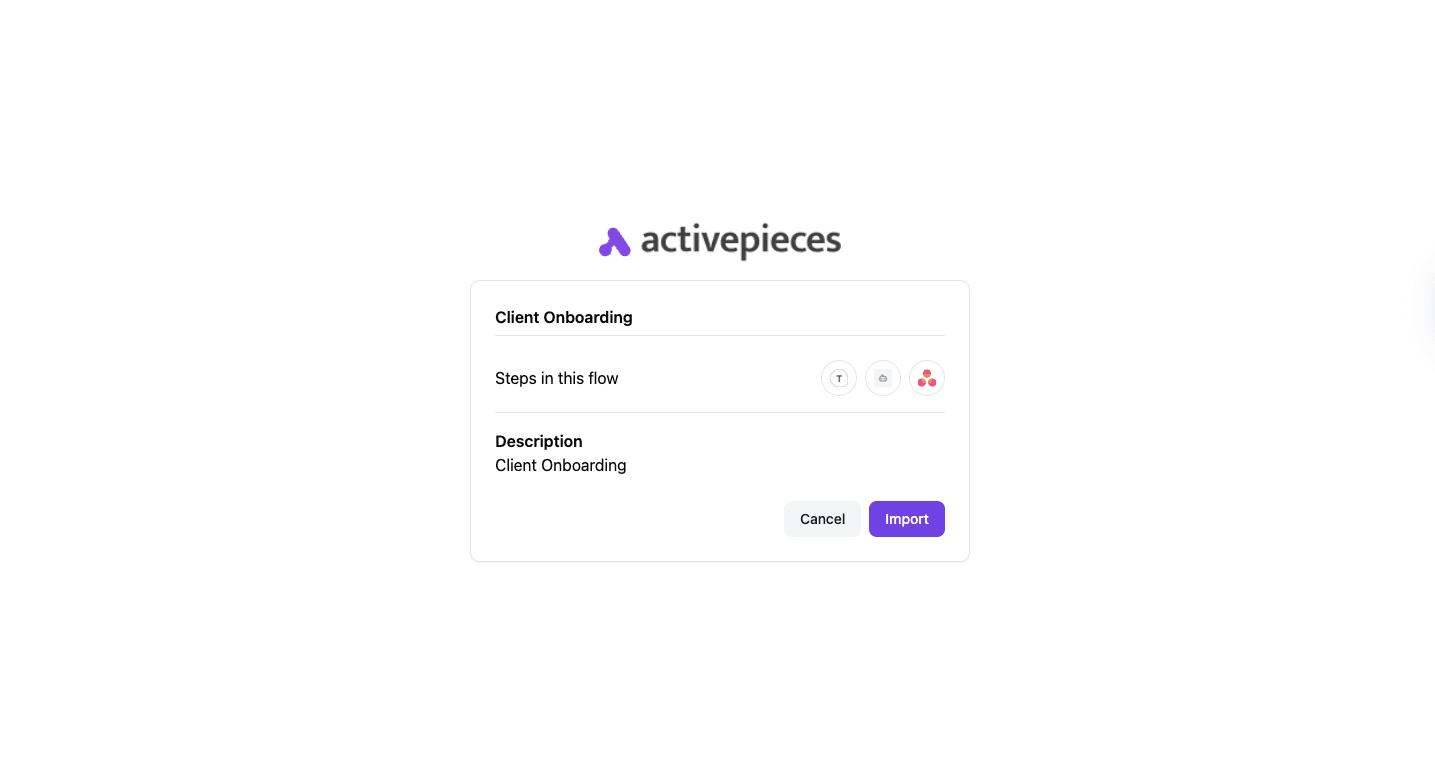

Client Onboarding

Activepieces’ Client Onboarding workflow connects form submissions, customer profiles, and task management tools to make onboarding simple and fast. When a new client fills out a form, the system organizes their details and creates follow-up tasks automatically.

Process:

- Collects responses through tools like Typeform

- Summarizes client details into clear bullet points

- Creates tasks in Asana or similar apps with complete client info

- Keeps track of onboarding progress for every client

With this setup, onboarding becomes smoother, staff spend less time on data handling, and new customers experience a quicker start.

Get the template here: Client Onboarding

Simplify End-to-End Banking Processes With Activepieces

The banking industry handles huge amounts of data every day, from compliance reporting to customer onboarding. Many banks still depend on manual work that slows things down and increases the chance of mistakes.

Activepieces changes that by bringing all these moving parts together in one simple, no-code platform. As of now, it includes 450 data integrations, so it fits perfectly into a bank’s existing setup because it can integrate seamlessly with core banking systems.

As it removes repetitive tasks, Activepieces gives you more room to analyze data and make better decisions. It further lets you modernize your workflows, reduce stress, and stay ready for the growing demands of digital finance.

FAQs About Automation in Banking

What is automation in banking?

Automation in banking means using technology like robotic process automation (RPA) and business process automation (BPA) to handle repetitive work such as data entry, transactions, and customer service.

It also includes tools like natural language processing (NLP) and intelligent process automation that help you analyze data, detect fraud, and manage compliance.

Automation improves accuracy, speeds up decision-making, and reduces costs while maintaining regulatory compliance reporting.

What are the seven P’s of banking?

The seven P’s of banking are Product, Price, Place, Promotion, People, Process, and Physical evidence. These elements guide how banks design and deliver personalized services to meet customer expectations and stay competitive.

How does automation affect the banking industry?

Automation increases speed, accuracy, and efficiency in the banking industry. It cuts manual workloads, improves fraud detection, and enhances the customer experience by simplifying account management and loan processing.

What are three examples of automation?

Examples include automated payment workflows, online customer onboarding, and digital fraud detection. Each helps banks reduce errors, save time, and improve service quality.

Does banking automation help in compliance and risk management?

Yes. Automation strengthens compliance and risk management by monitoring transactions, flagging suspicious activity, and maintaining detailed audit trails. It makes sure banks meet regulations and operate securely.